With increasing interest rates and market corrections and declines, the headline media is winning the day by making you question whether real estate is a good investment.

Of course, we can all have perfect vision with hindsight and convince ourselves that we made the right decision in not getting into real estate investing. Plus it is easy enough to look at what has happened over the last two years and think that you missed the boat and now is not the time.

But those above-average increases were unusual for a number of factors;

- Historically low-interest rates – borrowing money was as good as free.

- Fewer homes were on the market, with many people choosing to refinance or renovate instead of move.

- Immigration housing needs continued to outstrip new building supply by quite a margin.

Add to that the pandemic shift of people looking to work from home, wanting more space or looking to move to where they wanted to live versus needing to live because of commuting and you had a ‘perfect storm’ in the economy.

But most real estate investors and those that have successfully made real estate a cornerstone of their wealth building will show you that the money they have made has been over the long term not in short market bursts or increases.

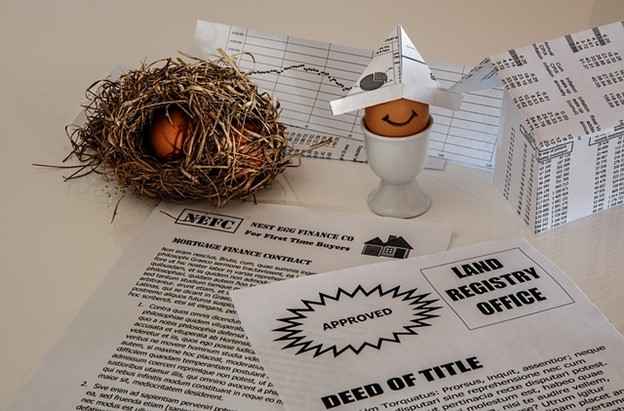

In fact, if you own your own home you are already a real estate investor. And if you have owned your own home for at least 10 years it’s highly unlikely that you have not made very consistent and reasonable gains. Building equity over time is the name of the game versus trying to second guess or time the market perfectly.

But what about now? Should real estate be part of your diversified wealth-building portfolio?

First, you want to be thinking longer term than a couple of years. If you make your investment as part of a balanced portfolio approach then you are not relying on one basket to deliver all your retirement eggs.

There can be certain tax advantages when you invest in real estate. Since real estate is a depreciating asset, the government allows you to claim that depreciation expense against your income which can prove to be significant tax savings if you hold a portfolio of real estate or even just one property. You will need to speak to a professional advisor like your accountant to fully understand what is possible but that is one of the strategies the wealthy employ.

Real estate can also provide you with a steady flow of income that could be part of your retirement monies. I think of the income generated from real estate as your own personal pension plan that can help supplement your existing pension plan perhaps offered by your company. Either you have the positive cash flow generated after your mortgage payment is made or it’s been paid off and you have an income that can sustain your lifestyle in retirement.

Many people can get put off real estate investing because they do not want all the day-to-day hassles of maintenance, dealing with tenants and the stress of running more than one home.

Partnering with a real estate investor who does this for a living can be a perfect way to benefit from investing in real estate without the challenges. Plus, that investor, because they do this all the time, is up to date with the latest and best strategies and approaches that will continue to offer the best returns.

For example, at the moment investing in multi-family buildings both in Canada and even looking into the United States can offer significant advantages over relying on a property with only one or two tenants. We will have a future article going into a lot more detail about multi-family investing in North America.

In the meantime, if you would like to explore how working with an experienced real estate investor can help you diversify your wealth building by taking advantage of real estate please reach out and book an initial, no-obligation call and ask your questions.