The rising demand for rental housing in Canada is causing a significant challenge for both tenants and investors. Record rent increases and plunging vacancy rates highlight the urgent need for more rental units.

In this blog post, we will explore the fierce demand in Canada’s rental housing market, the growing rental housing gap, and the opportunities it presents for investors.

Let’s dive into this exciting landscape and discover how we can turn challenges into profitable ventures.

Lots of People Need Rental Homes:

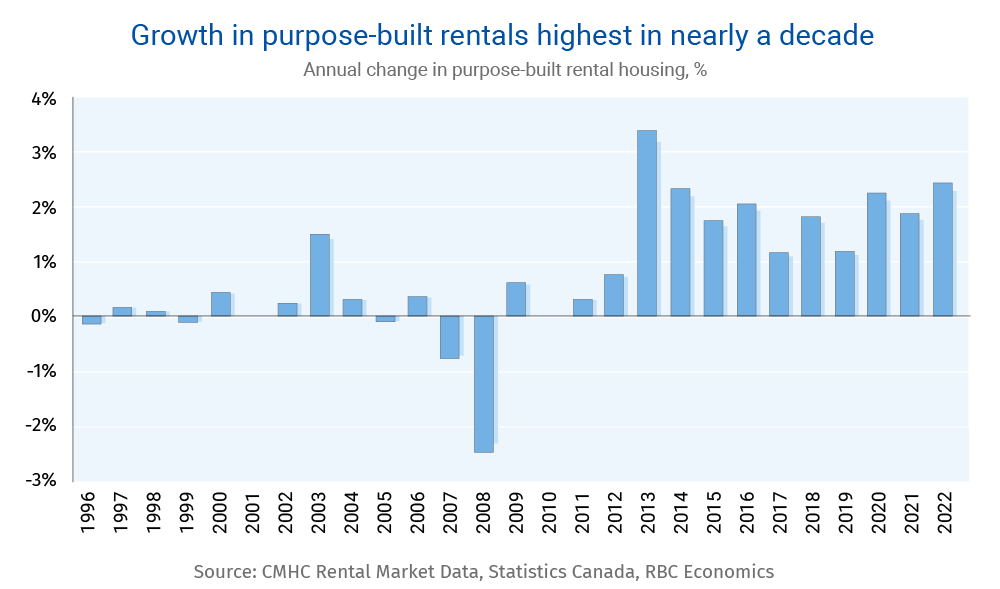

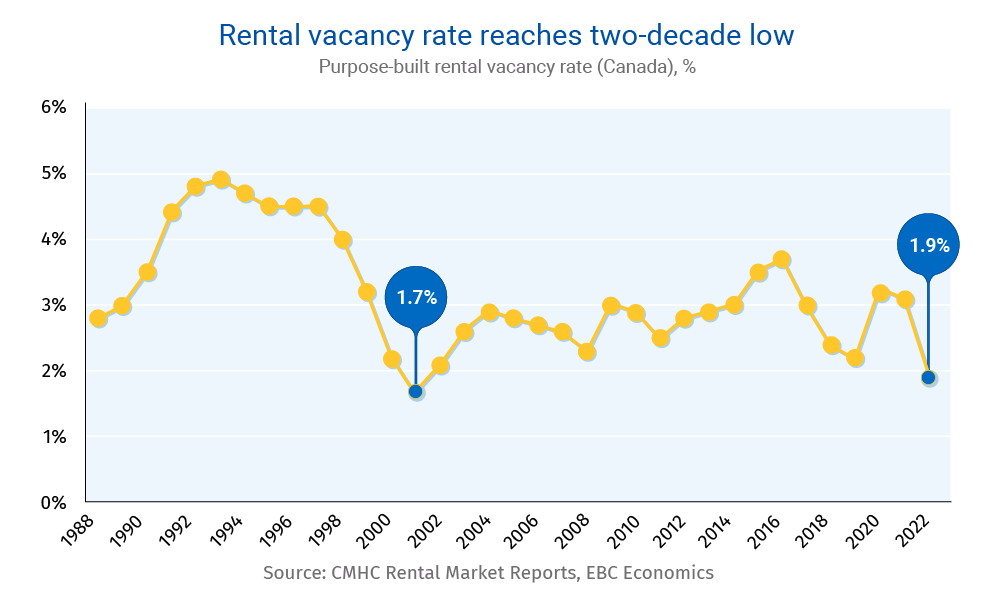

Even with a substantial increase in purpose-built rental housing last year, Canada’s rental stock is struggling to keep up with demand. The vacancy rate in this category hit a 21-year low of just 1.9% in 2022, leading to fierce competition among tenants. This competition, in turn, resulted in the highest annual rent growth on record. Rent for a 2-bedroom purpose-built unit increased by 5.6%, with cities like Gatineau, Toronto, and Calgary experiencing some of the highest jumps.

Rental Condo Market Squeeze:

The rental condo market in larger Canadian cities is facing an even tighter squeeze. Vacancy rates in cities like Ottawa-Gatineau, Toronto, and Calgary are among the lowest in the country, indicating intense competition that puts additional pressure on rents.

The Rental Housing Gap and Future Projections:

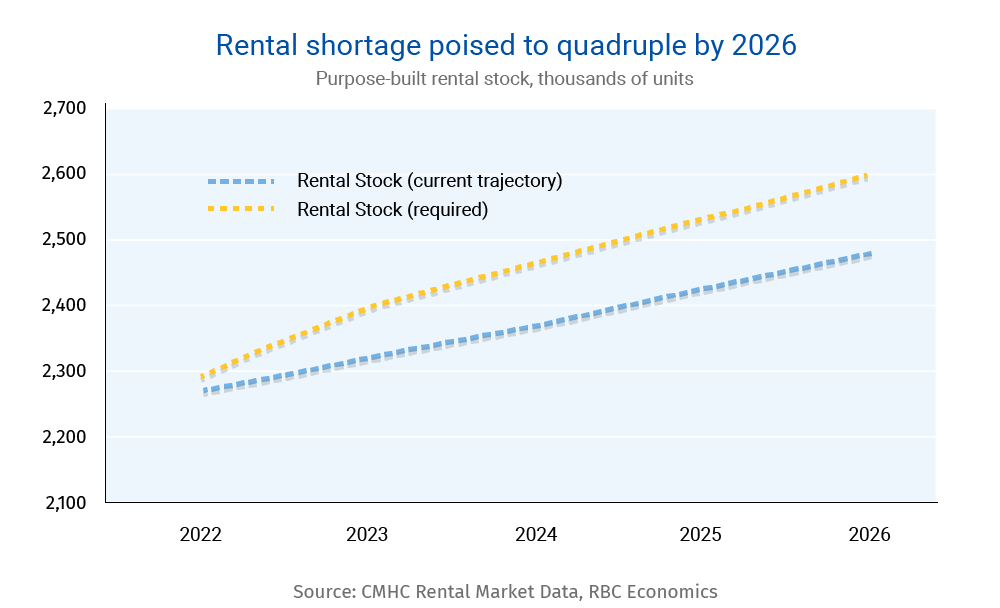

The rapid absorption of new rental units highlights the severity of the rental housing gap. This gap represents the difference between the projected rental stock and the stock required to achieve balance, maintaining a 3% vacancy rate while meeting future demand. With high in-migration levels and a shift towards rental housing due to affordability struggles, Canada needs a significant acceleration in supply to return to an optimal vacancy rate.

Projected Shortage and Growth Opportunities:

Currently, Canada faces a 25,000–30,000-unit deficit in purpose-built rental stock. However, this shortfall is expected to grow exponentially over the next four years as demand continues to rise. By 2026, the rental housing gap could exceed 120,000 units, nearly quadrupling the current shortfall. To achieve a balanced market with rent stability, Canada would need to add 332,000 rental units to its stock by 2026.

Embracing the Challenge and Investment Potential:

To address the growing demand and create stability in the rental market, various solutions are needed. Converting condo units, repurposing commercial buildings, and adding rental suites to existing homes can help ease the pressure. However, these responses alone may not be sufficient. The real opportunity lies in significantly growing the supply of purpose-built rentals. Investors have a chance to play a vital role in meeting the demand for rental housing while capitalizing on the potential for long-term value appreciation and steady rental income.

The rental housing challenge in Canada brings with it great potential for investors. The growing demand and widening rental housing gap create opportunities for those willing to seize them.

By investing in purpose-built rentals, converting properties, and actively participating in the rental market, investors can contribute to meeting the demand while enjoying the benefits of a thriving rental market.

Let’s embrace this challenge and unlock the potential for financial growth and stability in Canada’s rental housing sector.

Interested to explore the opportunities in Canada’s rental housing market?

At TruCapital Real Estate, we help busy professionals invest in real estate and take them through goal assessment, to acquisition, renovation/construction to asset stabilization and property management. If this is of interest, reach out to set up a call.

[Connect with TruCapital Real Estate]